Financial Capability

Empowering Communities Financial Wellbeing & Resilience

The Financial Capability Programme is dedicated to improving the financial wellbeing of ethnic minority communities across Scotland. Through tailored workshops and one-to-one guidance, we’re helping individuals build the knowledge and confidence they need to take control of their financial futures.

Our Impact

1080+

100%

About

We deliver:

• Interactive financial workshops on budgeting, saving, debt management, and more.

• One-to-one money guidance tailored to individual needs and circumstances.

• Culturally sensitive support that respects and reflects the diverse communities we serve.

Our goal is to ensure that everyone, regardless of background, has access to the tools and support needed to make informed financial decisions

With Support From Our Funders

The Financial Capability Programme is proudly supported by The Robertson Trust, whose commitment to tackling poverty and inequality in Scotland has made this work possible. Their funding enables us to deliver free, accessible financial education and one-to-one support to ethnic minority communities across Scotland.

We are grateful for their continued partnership in building a more financially inclusive Scotland.

Awards

Scotland Money Guider of the Year Award

In 2024, the programme’s Financial Capability Officer was honoured with the Scotland Money Guider of the Year Award, a national recognition of excellence in financial guidance and community impact. This award reflects the dedication and passion behind the Financial Capability Programme and its commitment to empowering ethnic minority communities across Scotland.

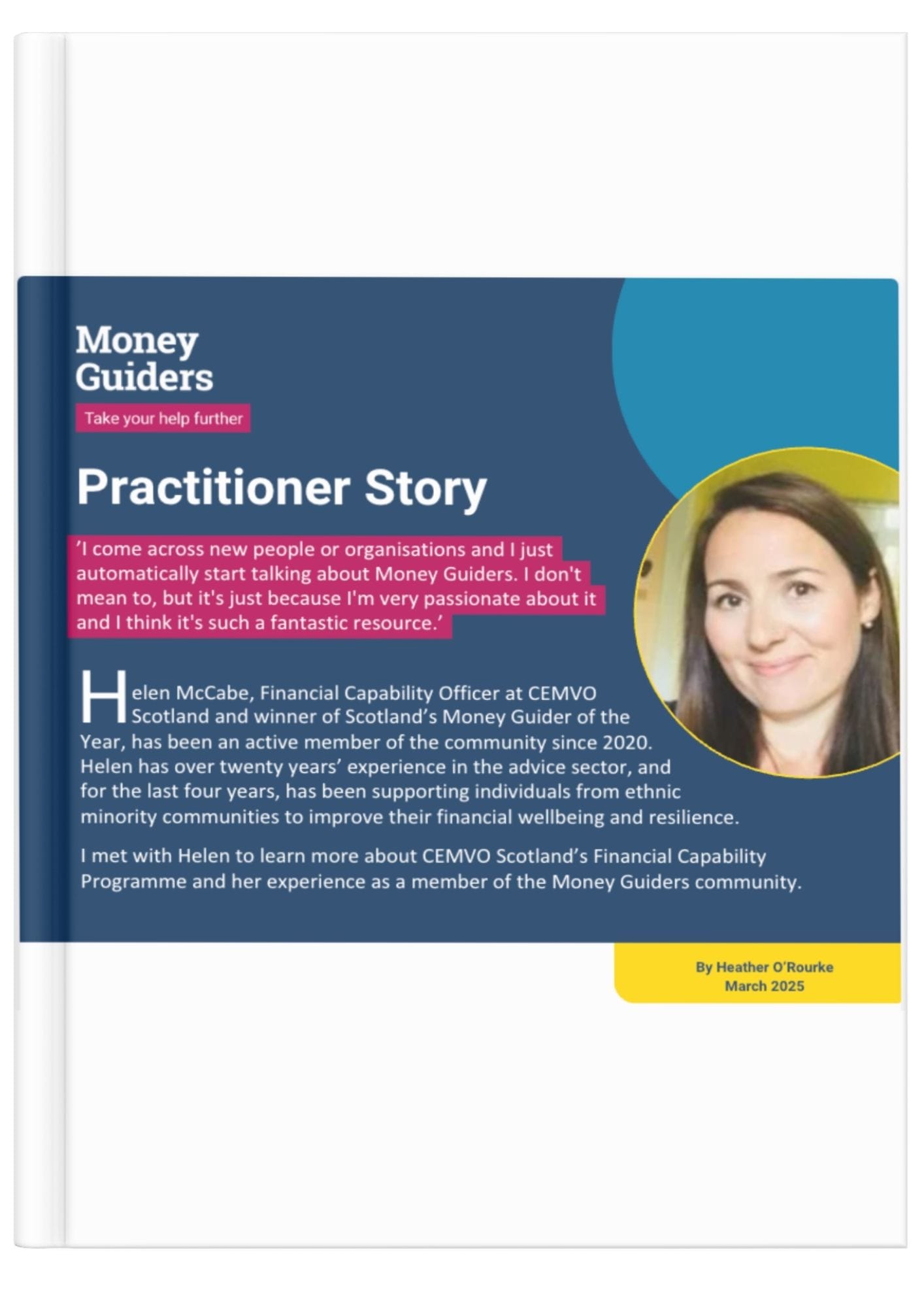

Publications

Fair4allfinance: Levelling the playing field – building inclusive access to financial

Money Advice Scotland: Practitioner Stories

Podcast

New Podcast Introduction

Budget Announcement Part 1

Budget Announcement Part 2

FAQs

What kind of financial support or advice do you offer? We

We do not offer debt advice, however we can help support and guide you to a choice of free, confidential impartial debt advice.

Who can attend your workshops or sessions?

Are your services free?

Do I need to book in advance?

Where are the sessions held?

How long does each session last?

Do you offer online or remote sessions?

What can I expect to gain from attending?

You will leave with practical tools, increased confidence, and a better understanding of how to manage your money and make informed decisions.

How will this help me manage my money better?

Are you materials translated or simplified?

Do you provide support for people whose first language isn’t English

Yes we can adapt our materials to be clear and simple, and we’re happy to work with interpreters or support workers if needed.

Can someone attend with a support worker or interpreter

Absolutely. We welcome support workers, interpreters or friends to attend with you if it helps you feel more comfortable

What topics do your workshops cover?

Will I get one-to-one advice?

Will my personal information be kept confidential?

Can I speak to someone privately?

Ready to take control of your finances?

Join one of our upcoming workshops or book a one-to-one session with the Financial Capability Officer

Key Contact

Get involved get in touch with Financial Capability Officer:

Helen.mccabe@cemvoscotland.org.uk

Visit our website or download our brochure